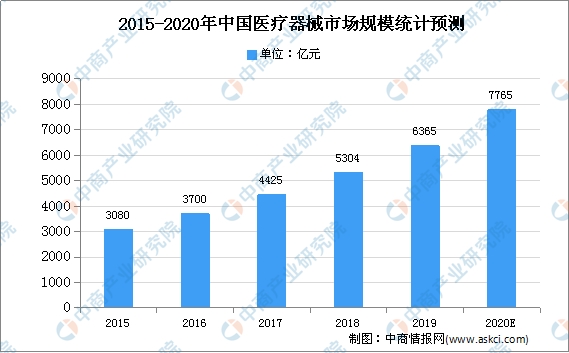

With sustained development, increasing per capita disposable income, increasing public health awareness, intensifying social aging trend, and the upgrading and policy support of the medical device industry, China's medical device industry will maintain high-speed expansion. Data shows that the size of China's medical device market in 2018 was approximately 530.4 billion yuan, a year-on-year increase of 19.86%, close to four times the global growth rate of medical devices. The China Academy of Commerce and Industry predicts that the size of China's medical device market will reach 776.5 billion yuan in 2020.

Data source: "China Medical Device Blue Book", compiled by China Academy of Commerce and Industry

Difficulties in the development of the medical device industry:

1. The hospital procurement management process is complex

According to laws and regulations such as the "Management Measures for the Configuration and Use of Large Medical Equipment (Trial)", national regulatory agencies mainly adopt product catalog management for the configuration license of large medical equipment. If orthopedic surgical navigation and positioning robots or newly developed products are clearly listed in the category A or B of catalog management due to product types, a configuration license application needs to be submitted to the provincial health administrative department or even the National Health Commission.

2. Acceptance level of doctors and patients

Although robot assisted navigation positioning surgery has not made significant changes to doctors' surgical procedures, the time for orthopedic surgical robots to enter clinical surgical applications in China is relatively short, and robot assisted surgery is still in its infancy. Doctors have a process of learning and accepting the use of new technologies, and the establishment of patients' confidence in the effectiveness of robot assisted surgery also requires a process, which leads to some doctors The patient's unwillingness to try robot assisted surgery has caused certain difficulties for the issuer's product promotion.

3. High product prices and high surgical costs

Surgical robots are large-scale medical devices with high terminal prices, which is one of the reasons affecting the popularity of orthopedic surgical navigation and positioning robots. The cost of a surgery usually includes a series of fees such as surgery, anesthesia, hospitalization, blood transfusion, medication, examination, and consumables. At present, the fees for orthopedic surgical navigation and positioning robots are separately charged as a new item in the patient's surgical settlement, and the robot usage fees are approved by the local health regulatory department. The charging item for orthopedic surgical robots is a new medical service price item, which is currently only included in the medical insurance coverage in Jiangmen City, Guangdong Province. The disposable sterile positioning tool kit has not been separately included in the medical insurance coverage. Therefore, patients choose to use orthopedic surgical navigation positioning robots and disposable sterile positioning tool kits, which will increase the economic burden.

Development prospects of the medical device industry

1. There is significant room for improvement in the proportion of medical device expenses to healthcare expenses and per capita medical device expenses

Due to the late start of China's medical device industry and the long-term industry model of "relying on medicine to support medicine", enterprises have placed more emphasis on investment and development in the drug market, resulting in the current situation of China's medical device market lagging far behind the drug market. With the rapid development of medical devices in China, the domestic pharmaceutical market is transitioning from "heavy drugs over light devices" to "balanced development of drugs and devices". At the same time, medical device companies are also undergoing a shift from quantity to quality, from imitation to brand building. The gap between the medical device and drug markets is gradually narrowing. In the future, the development potential of China's medical device market is enormous, and the per capita medical device cost is expected to steadily increase.

2. The increase in per capita disposable income drives the growth of urban and rural healthcare expenditure

With the rapid growth of China's GDP, the per capita disposable income has also significantly increased. In 2019, the per capita disposable income of residents in China was 30733 yuan, a year-on-year increase of 8.44%. The household healthcare expenditure of urban and rural residents is showing an overall upward trend, and the proportion of per capita consumption expenditure is also increasing year by year, driving the development of the medical device market.